Felix & Company Reports the Following Information.

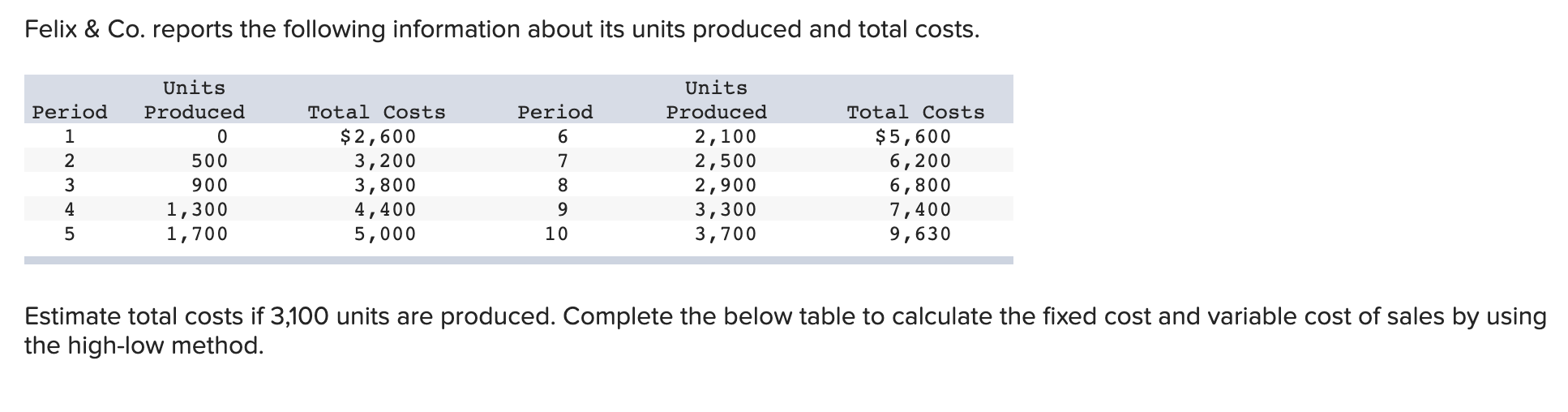

Felix Co reports the following information about its units produced and total costs. 7 8 9 10 Use spreadsheet software to use ordinary least-squares regression to estimate the cost equation including fixed and variable cost amounts.

Addressing Climate Related Financial Risk Through Bank Capital Requirements Center For American Progress

Reports the following information about its sales and cost of sales.

. Donna uses direct labor hours as an overhead base. Felix Companys retained earnings at the start of the year was 300000. Period Units Produced Period points Total Costs 2500 3.

Delta Insurance has a retention limit of 200000 or 18 of the total amount. Reports the following information about its units produced and total costs. Felix Company reports the following information.

Net income 300 Decrease in plant and equip. A The total amount of insurance in force is 1600000. When deploying software releases and updates we follow a series of measures to ensure that information security requirements and measures are met.

180 480 Units Produced 2080 2480 2880 3280 880 1280 1680 Total Costs 5580 6180 6780 7380 8836 eBook Hint Print Estimate total costs if 3080 units are produced. Draw an estimated line of cost behavior using a scatter diagram and compute fixed costs and variable costs per unit sold. The company has two products.

The following information is available for Felix Company. Cost of Goods Manufactured 74100 Manufacturing Overhead 18500 Finished Goods Inventory March 1 4000 Finished. E1-24 Using the accounting equation 20 points The records of Felix Company show the following at December 31 2018.

Net income 300 Decrease in plant and equip. Accounts payable 80000 Accounts receivable 60000 Cash 140000 Common stock 120000 Dividends 40000 Equipment 300000 Salaries expense 500000 Service revenue 560000 Supplies 200000. Company reports are available for all equity exchanges supported by the application.

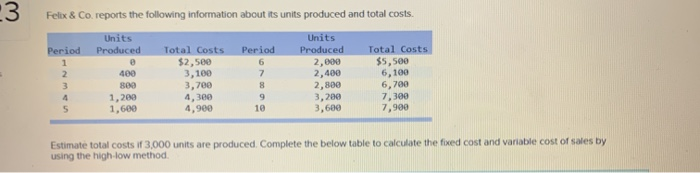

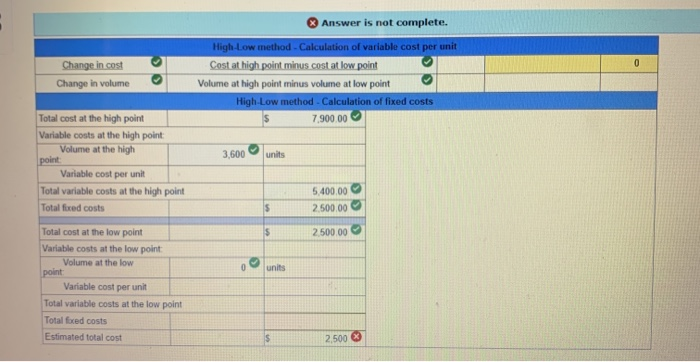

Candy A and Candy B. Felix Company reports the following information. Period Units Produced Total Costs Period Units Produced Total Costs 1 0 2500 6 2000 5500 2 400 3100 7 2400 6100 3 800 3700 8 2800 6700 4 1200 4300 9 3200 7300 5 1600 4900 10 3600 7900 Estimate total costs if 3000 units are produced.

At the end of the current year its accounts had the following balances. 40 5 50. 40 Depreciation expense 20 Increase in deferred tax asset 5 Gain on sale of assets 35 Decrease in long-term debt 50 Increase in inventories 25 Decrease in accounts payable 15 What is cash from financing activities for Felix Company.

The following information relates to Donna Corporation for the last year. Felix Time Company manufactures and sells watches for 40 each. Delta Insurance will pay 18 of the 800000 loss or 100000.

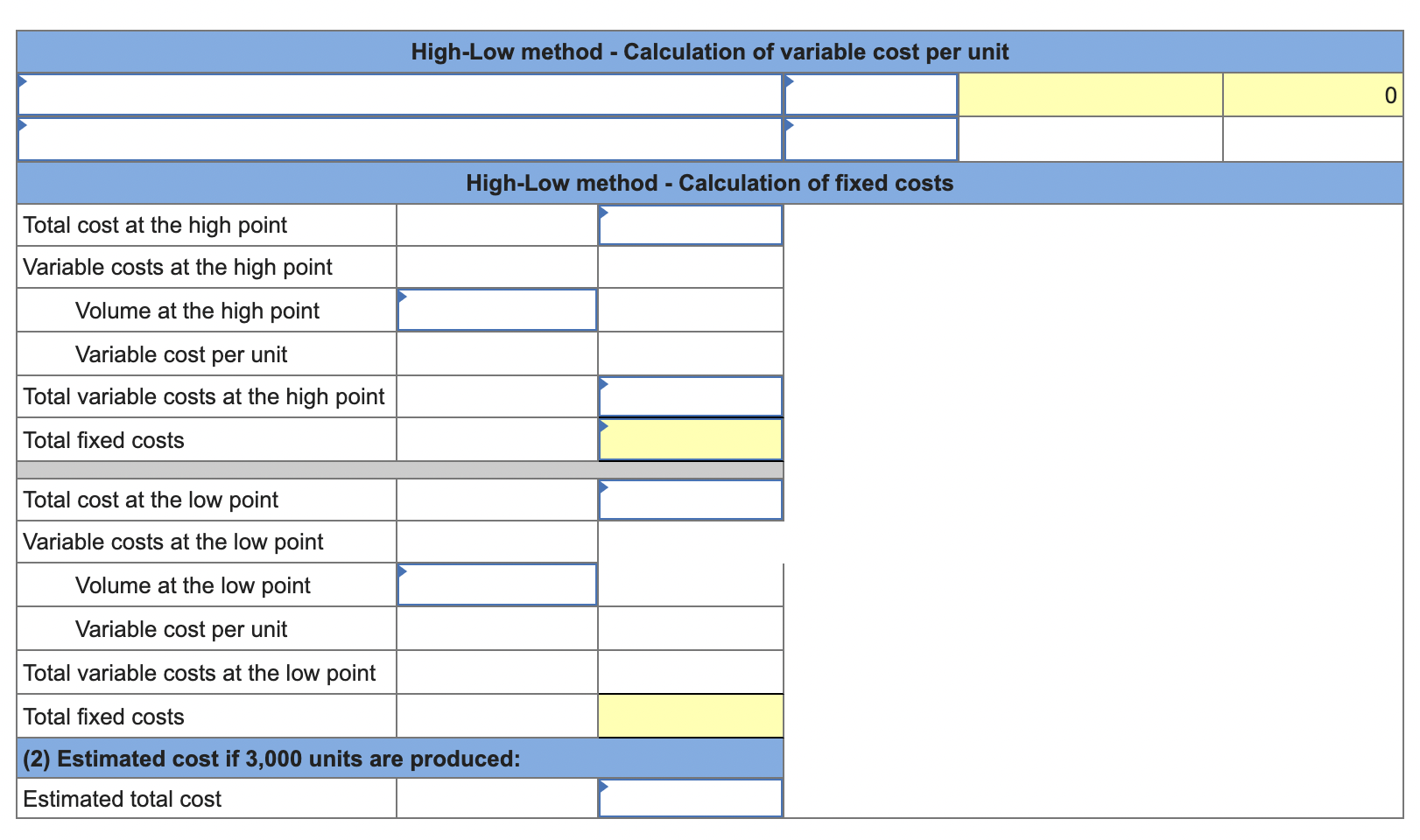

Shore Company reports the following information regarding its production cost. A secure deployment policy is in place and secure engineering principles are established. Reports the following information about its units produced and total costs Units Produced Period Period 400 Units Produced 2000 2400 2800 3200 3600 Total Costs 2500 3100 3700 4300 4900 Total Costs 5500 6100 6700 7300 7990 800 1200 1600 Estimate total costs of 3000 units are produced Complete the below table to calculate the fixed cost.

Then use the high-low method to estimate the fixed and variable components of the cost of sales. Period Units Produced Total Costs 4680 3980 4380 4980 4080 4 280 8780 16180 4980 12240 1 2 580 3 980 1380 1780 2180 2580 2980 3380 3780 4 5 6. The News command displays the most recent 500 news headlines for all news categories.

Total variable cost per unit is 1925 consisting of 1015 in variable production cost and 910 in variable selling. With the following practices and processes in place it makes Felix difficult to exploit by malicious attackers. The reports are available in the following commands.

Food and Drug Administration is alerting consumers who have purchased Felix Custom Smoking branded products directly from the firm as well as companies and. Complete the below table to calculate. 6039 Quaker Corporation sold 6600 units of its product at a price of 4240 per unit.

August 27 2021. Reports the following information about its sales and cost of sales. Owner contribution 11000 Assets 67000 Owner withdrawal 8000 Liabilities 11000 Revenues 205000 Ending.

Reports the following cost information for March. Times Products Company has offered Felix Time 25 per watch for a one-time order of 5000 watches. Draw an estimated line of Vcost behavior using a scatter diagram and compute fixed costs and variable costs per unit sold.

Draw an estimated line of cost behavior using a scatter diagram and compute fixed costs and variable costs per unit sold. Depreciation expense 20 Increase in deferred tax asset Gain on sale of assets 35 Decrease in long-term debt Increase in inventories 25 Decrease in accounts payable What is cash from financing activities for Felix Company. 3 Felix Co.

Then use the high-low method to estimate the fixed and variable components of. 40 Depreciation expense 20 Increase in deferred tax asset 5 Gain on sale of assets 35 Decrease in long-term debt 50 Increase in inventories 25 Decrease in accounts payable 15 What is cash from financing activities for Felix Company. For more information see News.

Draw an estimated line of cost behavior using a. Reports the following information about its sales and cost of sales. B Delta Insurance has a retention limit of 200000.

The annual production sales of Candy A are. The following information is available for Felix Company. Assets 46000 Liabilities 34000 Requirements 1.

The headlines update live and display in chronological order. Reports the following information about its sales and cost of sales. Period 1 2 3 4 5 Units Produced 0 400 800 1200 1600 2000 2400 2800 3200 3600 Total Costs 2500 3100 3700 4300 4900 5500 6100 6700 7300 7900 6 7 8 9 10 1 Use the high-low method to estimate the fixed and variable components of total costs.

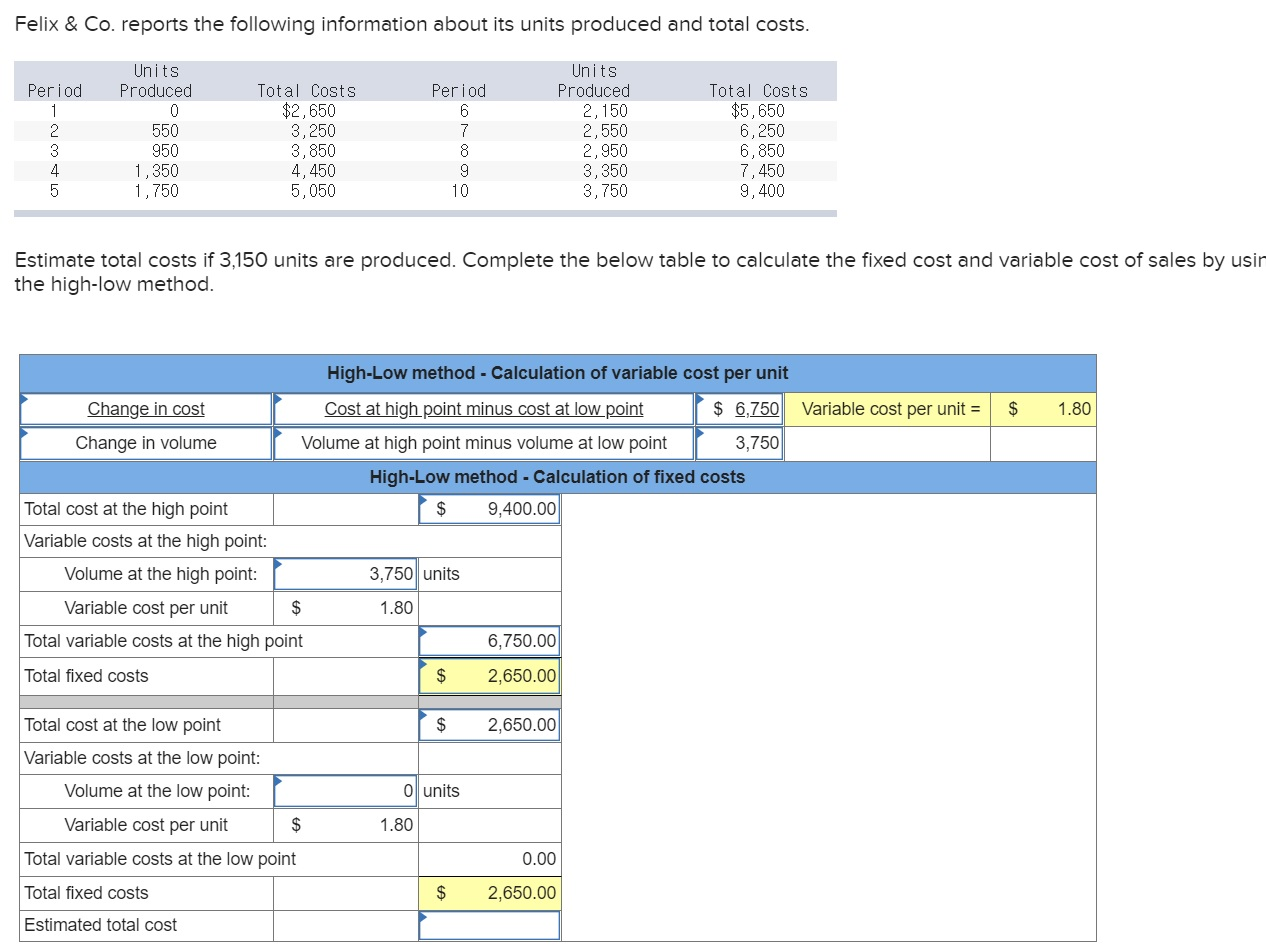

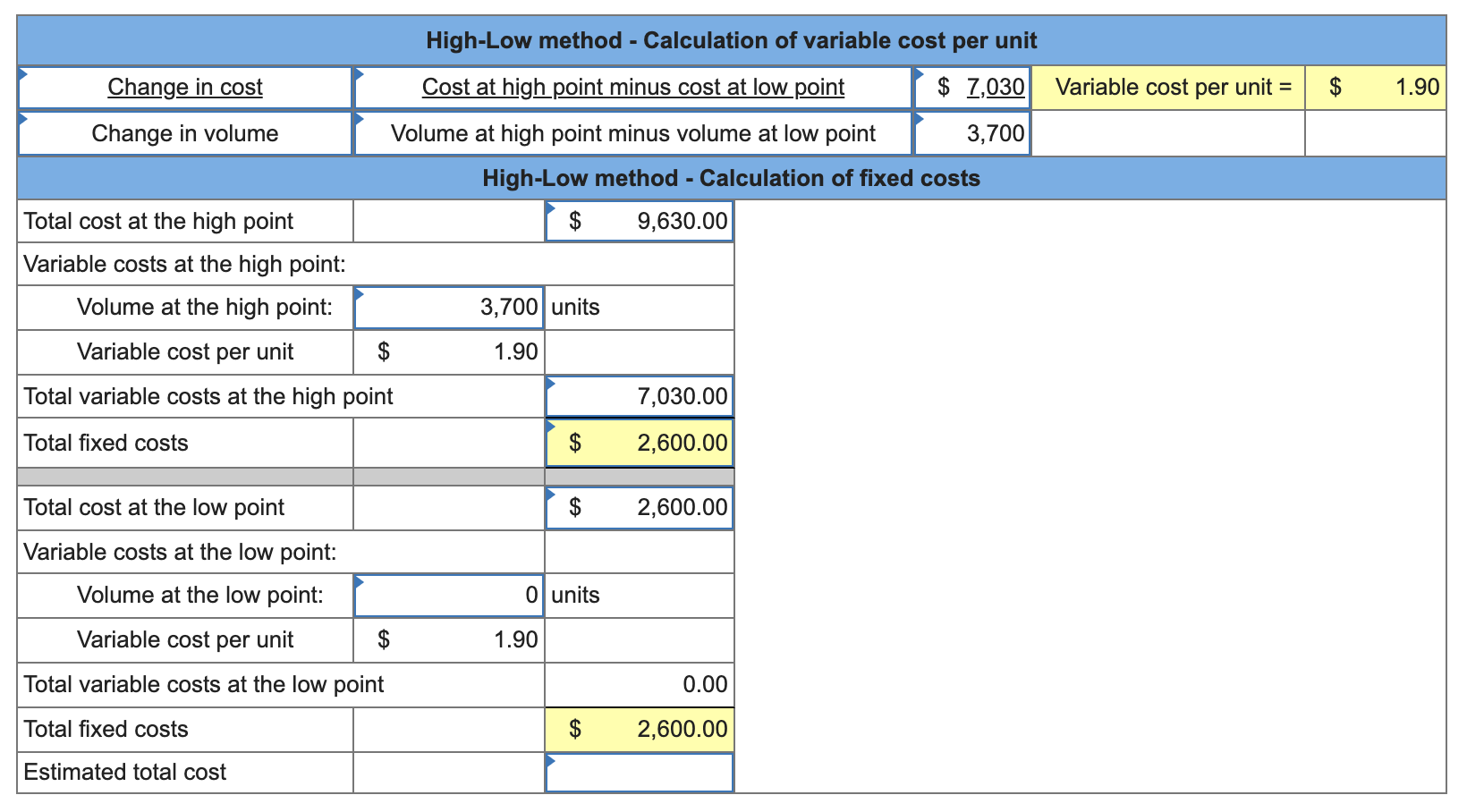

Then use the high-low method to estimate the fixed and variable components of the cost of sales. Period 1 2 3 4 5 Units Produced 0 550 950 1350 1. Candice Company uses activity-based costing to determine the unit product costs for external reports.

Question 3 The following information is available for Felix Company. Net income 300 Decrease in plant and equip. Reports the following information about its units produced and total costs.

Compute production cost per unit under absorption costing.

Chart Sprint T Mobile Merger To Leave Three Giant Carriers Statista

Solved Felix Co Reports The Following Information About Chegg Com

Solved 3 Felix Co Reports The Following Information About Chegg Com

Image Courtesy Of Reddit Com Continental Philosophy Tech Company Logos Pie Chart

Solved Felix Co Reports The Following Information About Chegg Com

Associated Press Ap Style Guide The Basics Writing Center Quick Writes Language Mechanics

10 Epic Works Of Ascii Art Ascii Art Ascii Epic

Solved 3 Felix Co Reports The Following Information About Chegg Com

Solved Felix Co Reports The Following Information About Chegg Com

Ch01 Solution W Kieso Ifrs 1st Edi

Solved Felix Company Reports The Following Information Chegg Com

Solved Felix Co Reports The Following Information About Chegg Com

Travel And Expense Policy And Procedure Legal Forms Investment Club Lesson Plan Template Free

Restructuring Costs Financial Edge

Restructuring Costs Financial Edge

Sample Fire Investigation Report Template 2 Templates Example Templates Example Report Template Incident Report Pamphlet Template

Comments

Post a Comment